Subscription Services

Subscription Services

Access to Veralytic Reports, analytical services, and special portfolio management tools are provided through member subscriptions. We offer three subscription options:

ONLY subscribers have access to Veralytic Reports, analytical services, and special portfolio management tools and your satisfaction is guaranteed.

A La Carte

$0

Per month

Don’t know whether a life insurance proposal or inforce policy is in your client’s best interest? Veralytic reports are available for a fixed price per report with no ongoing subscription fees.

$0 recurring

$0 recurring

$500 per report (Discounts available for large portfolios. Contact us for pricing after sign‑up.)

$500 per report (Discounts available for large portfolios. Contact us for pricing after sign‑up.)

Standard Support

Phone & Email

Single‑User License for Individual Advisors

$199

Per month

Individual subscribers have access to unlimited Veralytic Reports at a flat rate of $199 per month (for 12 months). There are no additional charges per report. This is intended for use by an individual subscriber for use in that advisor's practice only with that advisor’s clients.

Enterprise License for Multiple‑Users & Corporate Accounts

$TBD

Per month

Need access to Veralytic Reports for multiple advisors and/or third-parties (e.g. Registered Investment Advisors, Trust Companies/Departments, Wealth Management Firms, etc.), let us custom‑tailor a license for you.

Pricing based on the number of advisors and expected volume of reports.

Pricing based on the number of advisors and expected volume of reports.

Contact us for pricing after sign‑up.

Contact us for pricing after sign‑up.

Standard Support

Phone & Email

Solutions

Solutions

Everything you need to serve your next client.

Veralytic offers a number of solutions to support life insurance and financial services professionals.

Veralytic Report

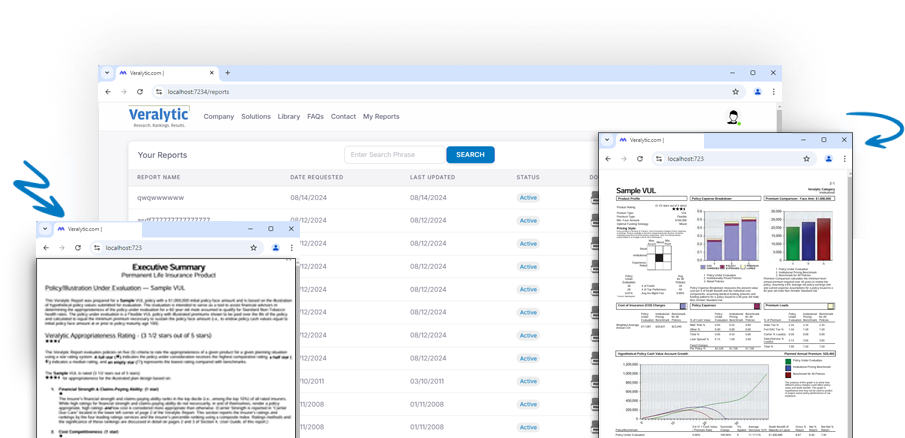

The Veralytic Report is our flagship product. The Report consists of several measures of policy suitability in an easy-to-read graphical overview, summarized by a simple star rating system that measures against five different categories of policy performance.

Subscription Services

Our subscription services provide access to custom Reports at a substantially discounted rate.

Insurance Banking® Support

Our Insurance Banking® Support provides Veralytic Certified Providers and Subscribers alike with pricing and performance research data on thousands of life insurance products and hundreds of insurance providers in North America.

Research Section

Our Research section describes the technologies, frameworks, and patents that underlie our Veralytic Reports and research services.

Excellent Support

An easy-to-use website with lots of reference material and support services.

Toolbox

Our Toolbox provides critical information, case law history, and resources for understanding and reducing risk which could result from non-compliance with the Uniform Prudent Investor Act (UPIA) for independent life insurance trustees (ILITS), agents, and agencies that manage life insurance assets for clients.

faq

faq

Frequently asked questions

Browse through these FAQs to find answers to commonly asked questions.

Veralytic Report requests and corresponding required data are submitted to this website via secure upload.

Submission requirements include:

- Veralytic Report Cover Page

- One NAIC-compliant inforce OR new business illustration of hypothetical policy values per submission for each policy under evaluation.

- Illustrations must be generated within the past 12 months for new business proposals and within the current policy year for in-force policies

- Illustration should correlate to client expectations

- Illustration must include all pages, disclosures and footnotes

- Illustration must include all future policy years

- For Universal Life or Variable Universal Life policies - the illustration must include detailed expense pages. If an insurer says in writing they cannot produce detailed expense pages please submit a copy of the policy contract and the most recent annual statement in addition to the illustration.

- For Whole Life policies - the illustration must include the current dividend scale.

- Insureds must be between the ages of 18 and 85 at the time of the request.

- Illustration should NOT include distributions (loans or withdrawals). Given the considerable differences in the way distributions are calculated by different insurers and in different products, and because the actual timing of distributions is almost never known with any certainty, Veralytic Reports cannot be run for illustrations that include distributions.

If your illustration does not comply with any of the above requirements, please click here.

Institutional pricing: Policies identified as "Institutional" are designed to include volume discounts and economies of scale available to large individual transactions and/or large groups of policies. As such, "Institutional" policies are characterized by high minimum policy face amounts and/or high minimum premium requirements, and offer low and/or levelized Premium Loads, and/or low Cash-Value-Based "wrap fees", and/or low or no Termination Fees (i.e., Surrender Charges), and/or low Fixed Administration Expenses, and/or low Cost of Insurance (COI) Charges. Depending upon the administrative requirements and/or underwriting concessions (e.g., Guaranteed Standard Issue or GSI arrangement in corporate benefits settings) for a given policy/group of policies, "Institutional" policies can include higher Fixed Administration Expenses, and/or higher Cost of Insurance (COI) Charges than "Retail" policies, so long as the total overall cost remains less than "Retail" policies.

Retail pricing: The Policies identified as "Retail" are designed to be available to the broadest possible market, and are priced for large, non-selective risk-pools of individual policyholders that rely on the "Law of Large Numbers" to provide the insurer with the greatest predictability in claims experience, but at the expense of averaging claims costs for high- and low-risk segments of the pool as well as higher operating expenses per policy. As such, "Retail" policies are characterized by low minimum policy face amounts and/or low minimum premium requirements, and high Cost of Insurance (COI) Charges, and/or high Fixed Administration Expenses, and/ or high Premium Loads, and/or high Cash-Value-Based "wrap fees", and/or high Termination Fees (i.e., Surrender Charges).

Institutional and Retail Pricing are determined by a variety of pricing factors, the two most notable are lower cost of insurance and/or lower expenses. Examples of Institutionally priced policies:

i. The Society of Actuaries (SOA) tracks policies with face amounts of $1,000,000 and more separately because the mortality rates for those policies are lower than that for policies with lower face amounts.

ii. Corporate Owned Life Insurance (COLI) policies tend to have lower cost structures that are spread out over time.

While not an automated, online product of Veralytic, we have developed in cooperation with our subscribers several of 1-page summaries of Veralytic Report finding for multiple policies. Please contact us to request a summary.

Our star rating is designed to help you match the individual measures of qualitative and quantitative attributes for each of the five (5) major factors of suitability to client needs and objectives. The distribution of star ratings does NOT follow a bell-curve pattern like some ratings systems because each of the five (5) stars separately measures the qualitative and quantitative attributes for each of the five (5) major factors of suitability. As such, Veralytic Star Ratings under 3 stars do not necessarily indicate that a policy should be replaced (e.g., the qualitative and quantitative attributes of a 3-star policy could match client needs/objectives) nor does a policy rated higher than 3 stars necessarily indicate that a policy should be maintained (e.g., any more than a 5-star emerging markets fund would be suitable for a conservative investor). One might observe that policies rated 3-stars or better are generally less likely to be replaced and policies rated less than 3-stars are generally more likely to be replaced. The above distinction is necessary because it is important to focus on both the overall star rating AND then also discuss and match the individual measures of qualitative and quantitative attributes for each of the 5 major factors of suitability to client needs/objectives.

The Veralytic Research Platform compares any given life insurance product holding to its peer group. To know how one particular product compares to another, you would simply request a Veralytic Report on each product. While there are many policy comparison/evaluation/audit systems available from distributors trying to sell some limited number of products, comparing only 2 products only tells you which of just those 2 are more competitive, but fails to help you choose a better product for the client from the entire universe of available products. Only by measuring pricing and performance against benchmark averages for peer-group products can you know just how competitive a particular product is in a particular client situation.

contact us

contact us

Lets work together

Any question or remark? just write us a message

Connect with us

Our office hours are 9:00am to 5:00pm EST Mondays through Fridays, with observation for major US holidays.

Please send all requests for information to:

Suite C

Tampa, FL 33612

Tel:(813) 908-8242 | Fax:(800) 409-3222 | E-mail: info@veralytic.com